After the implementation of Goods and Services Tax (GST) from July 1, everybody is busy finding out the percentage of GST levied on different products and services. In fact, to get rid of any confusion and chaos, the central government came up with an app called “GST Rate Finder”.

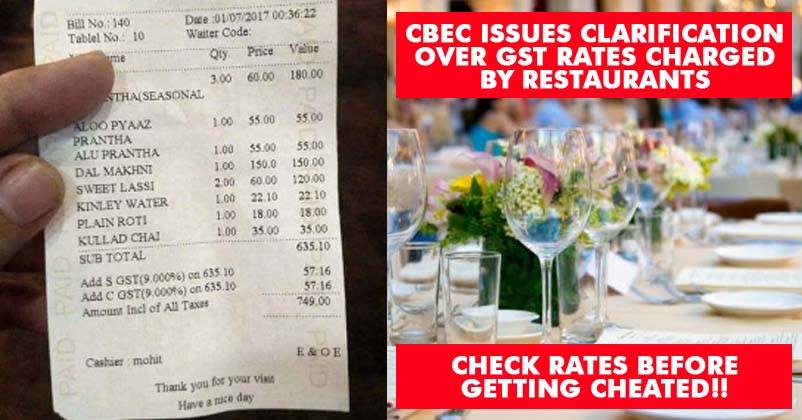

If you love to eat out, you must check your bill to make sure that proper rates of GST have been levied or not. Restaurants have come under two brackets of GST – 12% and 18% depending on the fact whether the restaurant is equipped with facilities like air conditioner or it has the permission to serve liquor to its customers.

One thing that should also be kept in mind is that in both the cases, state and central governments will be having equal share whether GST is 12% or 18%. The tax department has made it clear that no restaurant can charge 28% GST. The department has also stated,

“The actual GST incidence will be lesser due to increased availability of input tax credit.”

CBEC took to Twitter to clarify rates of GST for restaurants and posted this pic:

Here’s the tweet:

Clarification on rates of GST for Restaurants #GSTSimplified #GSTForCommonMan pic.twitter.com/io1fl3zLBg

— CBIC (@cbic_india) July 11, 2017

Those restaurants which are non-AC and don’t serve liquor will be charged 12% GST while the restaurants which are partial or fully air-conditioned and serve liquor will pay 18% GST. While the pre-cooked and pre-packed food items such as namkin will be attracting 12%. The food parcels made on order will attract GST depending on the type of the restaurant from they are bought.

Enjoy dining out but with the proper knowledge of GST!