Living in India is expensive. You have no job or jobs with low salary. Add to it you have to pay high prices for everything and then taxes are just bloodsuckers, to be honest.

Though nothing can beat the feel of Being an Indian, let’s have a look at the list of countries which don’t apply taxes on their citizens.

1. Qatar

People don’t need to pay any tax in Qatar except local source business income which is taxable at 10% rate.

2. Oman

There is absolutely no tax in Oman for personal revenues. Isn’t that great?

3. Bahrain

Bahrain citizens don’t pay any tax on income. However, they have to some indirect taxes like stamp duty of up to 3% of the value of the property on real estate transfers. Foreign expatriates are also required to pay a 10% municipal tax to rent a residence in Bahrain.

4. Vanuatu

It is also one of the rare tax-free countries where you can get temporary and permanent residency/citizenship through a donation.

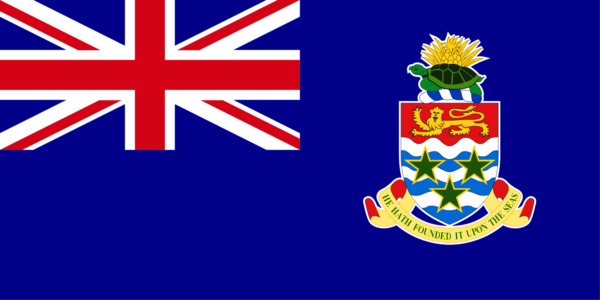

5. Cayman Islands

The country serves its citizens a tax free living but you need to have an annual income of nearly $150,000, and investment of $500,000 on real estate or local companies and it can possibly be your own company too.

6. Monaco

Another country that doesn’t levy taxes on the people.

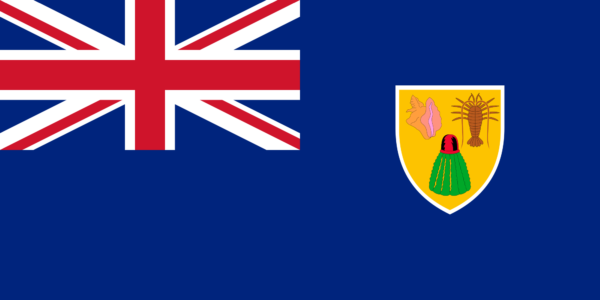

7. Turks and Caicos

This country holds an ultimate economic residency program for foreigners. Apart from being tax-free, it provides an easy permit to outsiders who spend at least $300,000 building a new house/ remodelling a distressed property, or invest at least $750,000 in a company that is majority-owned by locals.

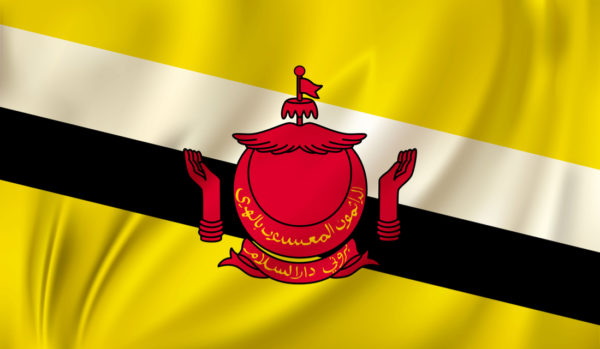

8. Brunei

A small but tax-free country on the island of Borneo provides great incorporation and banking options.

9. Bahamas

This country receives most of its revenue from tourism and its robust offshore industry. No income tax is taken from the people.

10. British Virgin Islands

Home of many entrepreneurs from all over the world, this place is best for those who want to legally avoid the taxes. You have to show your bank statements and pay a $1,000 surety bond to get the residency permit.

What do you think about it?